Character Shift in Volvo Cars – Report Breaks a Multi-Year Downtrend

Volvo Cars breaks a multi-year downtrend after a strong Q3 – profit lift and EX60 initiative signal a new phase

A trader’s journal on process, pressure, and the pursuit of clarity.

Disclaimer

The following analysis is AI-generated based on my template and news data.

Its purpose is to illustrate how I think as a trader, not to give a signal.

The material is refined in several stages; always verify data against original sources.

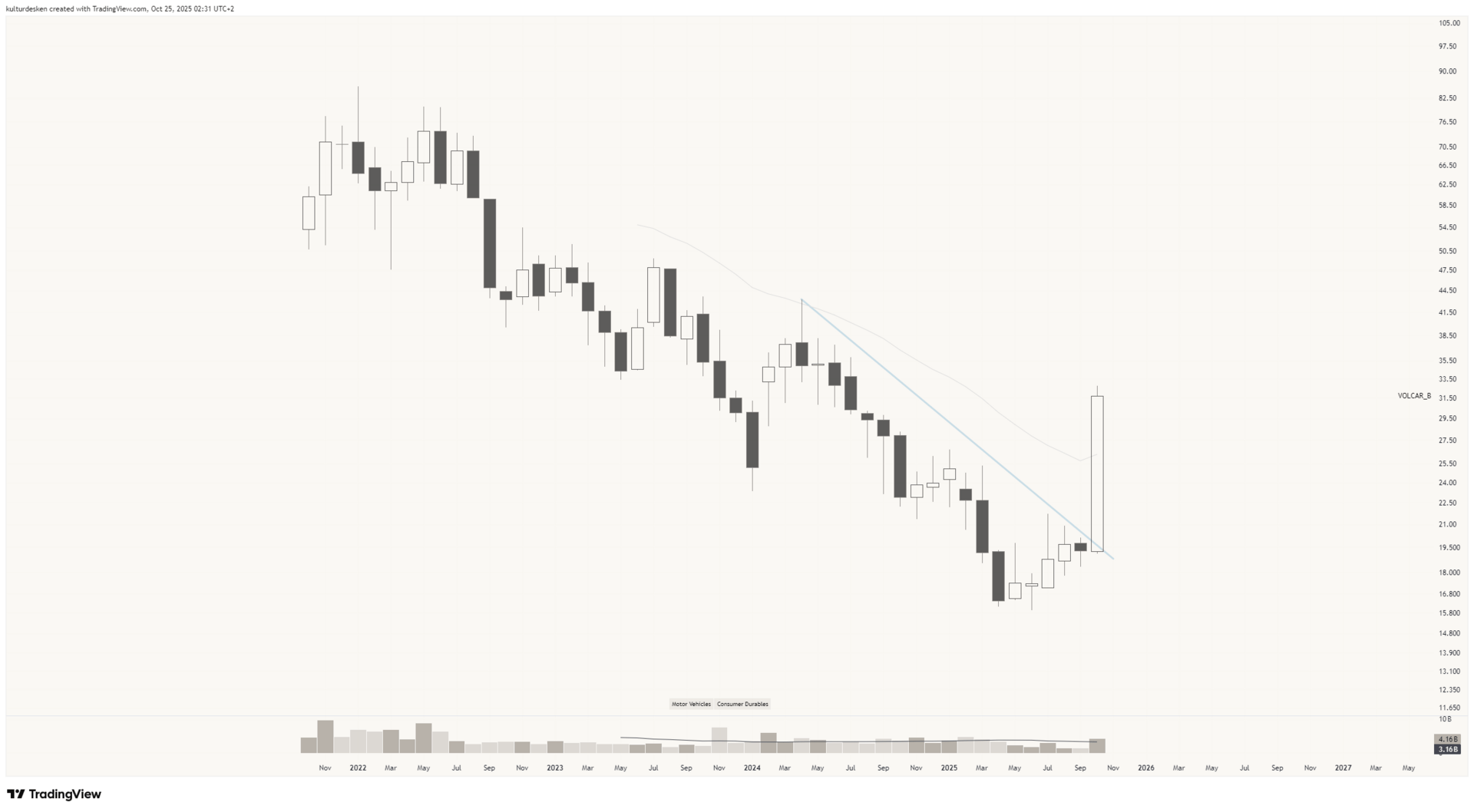

1. Structural Technical Picture (Monthly Chart)

Volvo Cars has been in a well-defined downtrend for several years but now shows a clear character shift.

Strong price expansion and volume acceleration – typical for phase 1 of an EP.

Breakout from a descending channel and above prior supply (22–25 SEK).

First serious thrust candle since the IPO.

Textbook EP: price breaks a long bear trend on a quality fundamental catalyst.

Monthly chart Volvo Cars B

2. The Report

The Q3 report is clearly better than expected:

EBITDA 12.1 bn vs est. 7.7 (+57 %)

Margin 14 % (11.2 %)

EPS 1.75 vs 1.41 (+24 %)

Cash flow –70 %, mainly due to inventory build-up ahead of EX60 launch.

Management signals the end of a heavy investment phase → entering a new, capital-disciplined era.

This is not just a beat – it’s a structural improvement in profitability.

Exactly the kind of fundamental shift that defines a sustainable EP.

3. Thematic Context

EV/BEV theme entering a new rotation phase – European makers regaining momentum.

Volvo positioning ahead of EX60 in an attractive segment.

Strong report + margin expansion + EV tailwind = new narrative phase.

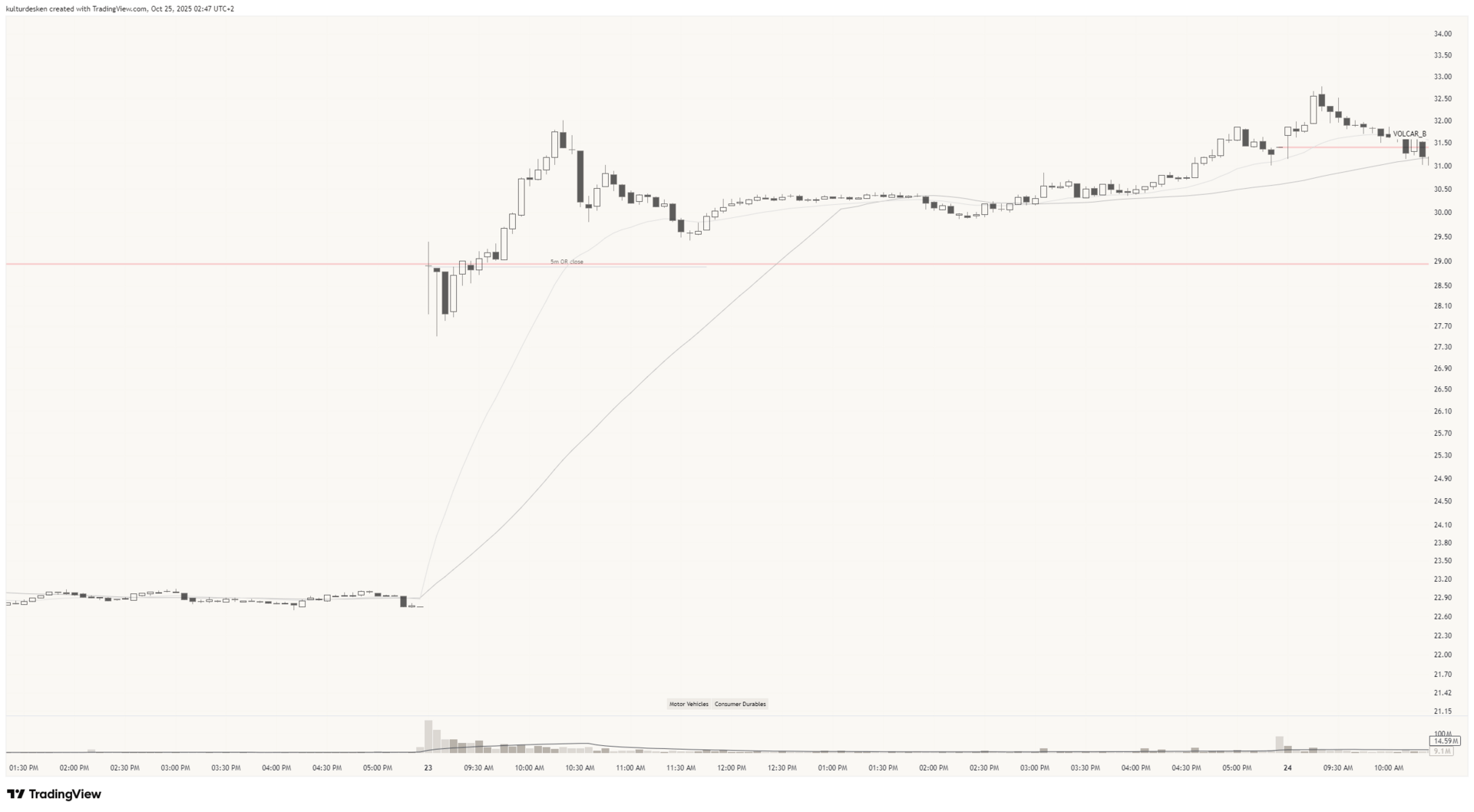

4. Tactical Setup

Gap-up from 21–23 to 27.5, continuing to 29.15 (+35–40 % thrust).

Volume > 3× average, EMA cluster and long-term trendline broken.

29–30 SEK: first supply zone (horizontal level).

24–25 SEK: natural pullback zone if consolidation occurs (≈ 30 % retrace).

27.5 SEK: gap-low = structural stop.

Statistically, stocks with this type of EP gap tend to trade higher after 1–3 months in about 70 % of cases, as long as the gap remains open.

5-minute chart Volvo Cars B

5. Conclusion

Setup: EP

Context: Post-IPO legacy → EV transition

New: EBITDA +57 % vs est, margin expansion, strong narrative shift

Notes: Violent thrust out of a long downtrend on strong volume. Supply 29–30, pullback spot 24–25.

Bias: Potential multi-bar drift over 1–3 months if the market accepts the new valuation regime.